close

Choose Your Site

Global

Social Media

Views: 0 Author: Site Editor Publish Time: 2025-09-25 Origin: Site

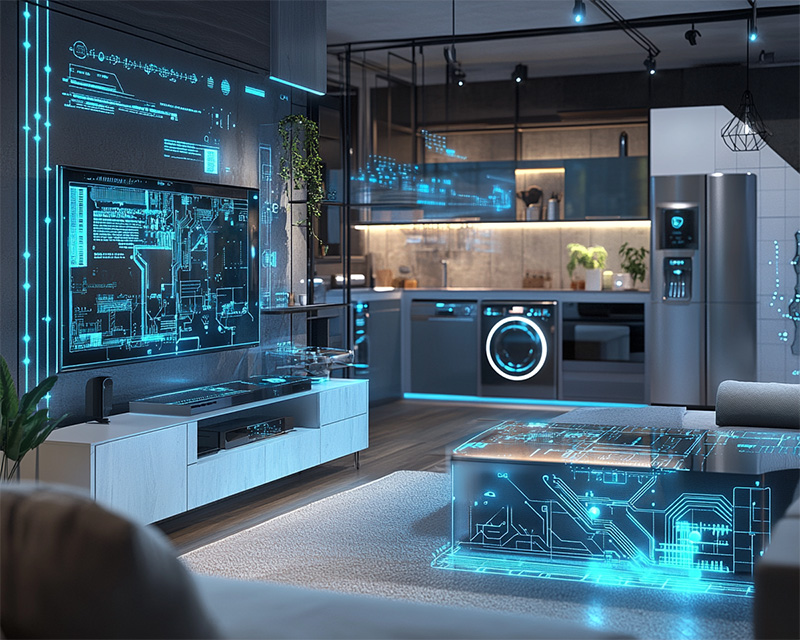

PCBs power everything from smartphones to cars. The global PCB circuit board market is booming in 2025, driven by 5G, EVs, and IoT. Choosing the right manufacturer is harder than ever. In this article, you'll discover the top PCB circuit board manufacturers, their strengths, and how to pick the right partner.

The demand for PCB circuit boards is rising sharply in 2025. The expansion of 5G networks requires high-speed, low-latency boards. Electric vehicles (EVs) also drive growth, as they need advanced PCBs for battery management and control systems. Artificial intelligence (AI) servers and IoT devices further expand usage. Data centers depend on high-density interconnect boards to manage computing loads. These sectors are pushing manufacturers to improve speed, heat resistance, and reliability.

Analysts expect the PCB industry to exceed $107 billion by 2027. Asia-Pacific remains the dominant hub, especially China and Taiwan, due to cost efficiency and manufacturing scale. Japan and South Korea lead in flexible and high-tech PCBs. North America, led by the U.S., focuses on aerospace and defense applications. Europe emphasizes sustainable and specialized production, often for automotive and medical electronics. Regional clusters reflect unique strengths and supply chain strategies.

Miniaturization continues to shape the market. High-Density Interconnect (HDI) boards dominate mobile devices and networking equipment. Rigid-flex PCBs gain traction in aerospace, wearables, and robotics, where flexibility and durability matter. Eco-friendly initiatives are also rising. Manufacturers are exploring halogen-free materials, recyclable laminates, and energy-efficient production processes. These innovations aim to balance performance and environmental responsibility, appealing to global brands focused on sustainability.

When choosing a PCB circuit board manufacturer, technology is the first factor. High-Density Interconnect (HDI) designs dominate smartphones and networking gear. IC substrates support advanced processors used in AI and 5G. Rigid-flex boards are critical for aerospace and robotics where durability and light weight matter. High-frequency boards serve automotive radar and data transmission needs. Buyers should confirm that a supplier can produce these advanced designs consistently, not just at prototype scale.

Certifications prove that a manufacturer meets international standards. ISO 9001 ensures quality management across the factory. RoHS compliance shows the use of safe materials without harmful substances. UL certification is crucial for safety in consumer and industrial electronics. Automotive projects often require IATF 16949 for quality across the supply chain. Without these credentials, risks of recalls and non-compliance increase. Always verify certificates are current and validated by independent bodies.

A reliable PCB circuit board supplier must handle both small runs and mass production. Startups often need fast prototypes with flexible order volumes. Established firms may require millions of units for global launches. Manufacturers with modular production lines can scale quickly while keeping costs predictable. On-time delivery is as important as production scale. Delays in PCB supply can slow product launches and damage customer trust.

Sustainability is no longer optional. Many top suppliers now use halogen-free laminates and energy-efficient plating lines. Some invest in recycling copper and resin waste to reduce environmental impact. Others adopt water-based cleaning instead of harsh solvents. These practices help companies meet regulatory rules and align with green business goals. Choosing an eco-conscious PCB partner also supports brand reputation, especially in markets that value sustainability.

Criterion | Why It Matters | Example Applications |

Technology Range | Supports advanced designs like HDI | 5G, AI servers, EV control units |

Certifications | Ensures safety and global compliance | Consumer electronics, automotive |

Production Capacity | Meets both prototype and mass demands | Startups, global product launches |

Sustainability | Reduces waste and improves reputation | EU green markets, eco brands |

Note: During supplier audits, request test samples of HDI or rigid-flex boards to confirm real-world capabilities.

Zhen Ding Technology is one of the largest PCB circuit board suppliers worldwide. It focuses heavily on high-density interconnect boards and flexible circuits. Its strength lies in semiconductor packaging, supporting miniaturized devices used in mobile, AR/VR, and IoT. Zhen Ding’s customers include top electronics brands and global foundries. Its ability to combine large-scale production with quick-turn prototyping gives it an edge in highly competitive consumer markets.

Unimicron, based in Taiwan, is consistently ranked among the world’s top PCB producers. It specializes in IC substrates and HDI boards used in 5G, AI servers, and automotive electronics. Its facilities extend across Asia, ensuring supply chain resilience. The company invests in R&D for embedded packaging and eco-friendly laminates. For buyers seeking advanced PCB circuit board solutions at scale, Unimicron is a proven choice.

TTM Technologies is the leading U.S. manufacturer of PCB circuit boards. It serves aerospace, defense, and high-speed computing markets. Its portfolio includes rigid-flex, RF, and thermal management boards. With plants in North America and Asia, it offers strong delivery reliability. TTM also holds numerous patents in RF and microwave technologies. This makes it ideal for clients that demand precision, durability, and global compliance.

Shennan Circuits is a top Chinese player in high-speed PCB production. It provides one-stop services covering design, fabrication, and assembly. Its expertise includes RF boards, chip packaging substrates, and thermal management solutions. These capabilities serve industries such as 5G telecom and advanced networking. For companies needing integrated supply and rapid scaling, Shennan is a strong partner in the PCB circuit board ecosystem.

Compeq has decades of experience in producing multilayer and HDI boards. It supports global brands in smartphones, networking, and IoT devices. Its factories in Taiwan and China focus on delivering stable quality at volume. Compeq’s long history of manufacturing makes it a reliable partner for consistent orders. Businesses that value heritage and steady growth often consider Compeq for their PCB circuit board needs.

Ibiden is a Japanese leader in IC substrates and ceramic-based PCBs. It supports high-performance computing and automotive electronics. Its strength lies in packaging for chip-on-board and flip-chip applications. These technologies make Ibiden essential for companies designing next-generation processors. For buyers seeking reliability and innovation, Ibiden provides specialized PCB circuit board solutions backed by a strong global R&D network.

Several other names also shape the 2025 market.

● Nippon Mektron (Japan): Known for ultra-thin flexible PCBs used in wearables and automotive.

● Tripod Technology (Taiwan): Offers high-capacity production of multilayer and HDI boards.

● AT&S (Austria): Invests in miniaturization and advanced substrate technologies.

● DSBJ (China): Specializes in flexible and rigid-flex boards for EV and LED markets.

Manufacturer | Strengths | Key Applications | Region |

Zhen Ding Tech | IoT & semiconductor packaging | Mobile, AR/VR, smart home | Taiwan/China |

Unimicron Technology | IC substrates, HDI, eco-materials | 5G, automotive, servers | Taiwan/China |

TTM Technologies | RF, thermal, aerospace focus | Defense, telecom, aerospace | USA/Asia |

Shennan Circuits | One-stop, RF & high-speed | 5G, networking, automotive | China |

Compeq Manufacturing | Multilayer & HDI experience | Smartphones, IoT, telecom | Taiwan/China |

Ibiden | IC packaging, ceramics | Automotive, HPC, processors | Japan/China |

Others (Nippon, Tripod, AT&S, DSBJ) | Flexible, multilayer, substrates | Wearables, EVs, industrial | Japan/EU/China |

Asia-Pacific continues to dominate the PCB circuit board industry. China and Taiwan remain global hubs for mass production and advanced HDI designs. Taiwan's Unimicron and Zhen Ding lead in IC substrates and flexible boards. Japan contributes with Ibiden and Nippon Mektron, known for high-reliability and flexible solutions. South Korea's YoungPoong Electronics strengthens its position in multilayer and high-power PCBs. Together, these countries cover volume, innovation, and high-end packaging needs.

Europe may not produce the largest volumes, but it excels in innovation and niche solutions. AT&S in Austria invests in miniaturization and high-frequency substrates. Würth Elektronik in Germany provides advanced PCBs for automotive and industrial electronics. Schweizer Electronic specializes in embedded solutions for aerospace and energy. European firms also push for sustainability, adopting eco-friendly laminates and advanced recycling. This region proves that innovation can rival scale in PCB circuit board manufacturing.

In North America, TTM Technologies leads with aerospace, defense, and high-performance PCBs. Its strength is in thermal-critical boards and RF solutions. Advanced Circuits, based in the U.S., focuses on prototyping and small-to-medium production runs. Both companies serve industries that demand fast turnaround and strict compliance. North American manufacturers may not compete in sheer volume, but they offer high customization and advanced certifications valued by global buyers.

Beyond the major hubs, new players are rising. In Southeast Asia, Vietnam and Malaysia are expanding capacity for rigid-flex and HDI boards. In Eastern Europe, smaller plants provide cost-efficient alternatives for industrial clients. Specialized firms in India focus on rapid prototyping and domestic electronics growth. These emerging suppliers offer flexibility and price advantages. They also create opportunities for diversification in the PCB circuit board supply chain.

Flexible and rigid-flex PCB circuit board designs are essential for devices where space and movement matter. Companies like Nippon Mektron and Zhen Ding focus on ultra-thin, bendable solutions for wearables and robotics. These boards combine durability with adaptability, supporting compact products without sacrificing strength. Their popularity grows in smartphones, medical sensors, and aerospace applications. Manufacturers that excel here typically invest heavily in materials research and precision etching.

High-frequency and RF boards serve telecom, radar, and satellite systems. Firms like TTM Technologies and Shennan Circuits lead in this segment. Their boards handle high-speed signals while minimizing interference. Applications range from 5G base stations to advanced automotive radar. Customers often require low-loss laminates and exact impedance control. Choosing the right partner ensures reliable performance where precision matters most.

Automotive electronics rely on multilayer and thermal management boards. Unimicron, Compeq, and DSBJ produce PCB circuit board solutions for EVs and smart vehicles. They design boards that handle high current, heat dissipation, and vibration. EV battery packs, control units, and charging systems all depend on these designs. Automotive suppliers also comply with strict certifications like IATF 16949, proving their quality and consistency.

Sustainability is reshaping the industry. AT&S and Kingboard Holdings emphasize halogen-free laminates and recyclable substrates. Some plants use water-based cleaning instead of chemical solvents. These eco-friendly PCB circuit board options help electronics brands meet regulatory and ESG goals. As buyers seek greener supply chains, manufacturers with certified eco-processes gain an advantage. They also reduce long-term risks linked to environmental compliance.

The PCB circuit board industry faces constant pressure from supply chain risks. Copper foil, laminates, and specialty resins remain sensitive to global price fluctuations. Disruptions from geopolitical tensions or shipping delays add uncertainty. To stay resilient, many manufacturers diversify suppliers and invest in local sourcing. Others build buffer stocks to ensure steady deliveries. This focus on resilience creates opportunities for firms that can guarantee reliable lead times.

Environmental compliance is another challenge shaping the market. Regulations in Europe and North America push for eco-friendly materials and reduced waste. PCB producers are adopting halogen-free laminates, lead-free solder, and closed-loop water systems. Green manufacturing also creates new market opportunities. Brands seeking sustainable electronics increasingly partner with certified suppliers. Those who fail to adapt risk losing contracts to competitors with greener operations.

Modern electronics demand smaller, faster, and more complex boards. Miniaturization drives the need for HDI, rigid-flex, and advanced IC substrates. This requires tighter tolerances, advanced imaging, and laser drilling. While challenging, it also opens doors for innovation. Companies that master these processes can serve high-growth sectors like 5G, AI servers, and EVs. Buyers often prioritize partners who can scale advanced designs from prototype to mass production.

Not every PCB circuit board supplier fits all industries. Consumer electronics often require high-volume, cost-efficient HDI boards. Aerospace and defense need boards that pass extreme reliability and thermal tests. Automotive suppliers focus on EV-ready boards with strong vibration resistance. Matching the right partner to your sector ensures performance and compliance. A mismatch may lead to costly redesigns or certification delays.

Prototyping is critical when launching new designs. A manufacturer that offers quick-turn prototypes allows faster testing and market entry. Lead times also determine competitiveness. For example, a 48-hour prototype can help a startup iterate quickly. Large firms also benefit when they test automotive or telecom designs before scaling. Buyers should confirm whether suppliers can handle both small samples and full production runs without delays.

Lowest price rarely equals best choice. A reliable PCB circuit board partner offers consistent quality, reducing defects and warranty claims. Long-term value also includes engineering support, compliance documentation, and stable delivery. Buyers should calculate the total cost of ownership, not just unit pricing. Choosing a slightly higher-priced supplier with better yield rates may save more in the long run.

Global suppliers like Unimicron or TTM Technologies offer advanced capabilities and worldwide reach. They are ideal for firms scaling across multiple regions. Regional suppliers in Vietnam or Eastern Europe often provide lower costs and flexible services. For niche applications, regional plants may deliver better responsiveness. The decision depends on project size, market focus, and risk appetite. Many companies blend both global and local partners for balance.

The top PCB circuit board manufacturers in 2025 lead in HDI, rigid-flex, RF, and automotive boards. The best choice depends on your industry and project scale. Success comes from focusing on innovation, eco-friendly processes, and strong partnerships. Companies like Dongguan Xinrongxing Technology deliver products with precision, durability, and reliable service, ensuring long-term value for global clients.

A: Leading companies excel in HDI, rigid-flex, and eco-friendly PCB circuit board production.

A: Match the supplier's strengths, such as automotive or aerospace PCB circuit board solutions, to your application.

A: China, Taiwan, and Japan lead due to scale, advanced PCB circuit board technology, and competitive pricing.

A: Yes, many leading suppliers now use recyclable laminates and halogen-free PCB circuit board materials.